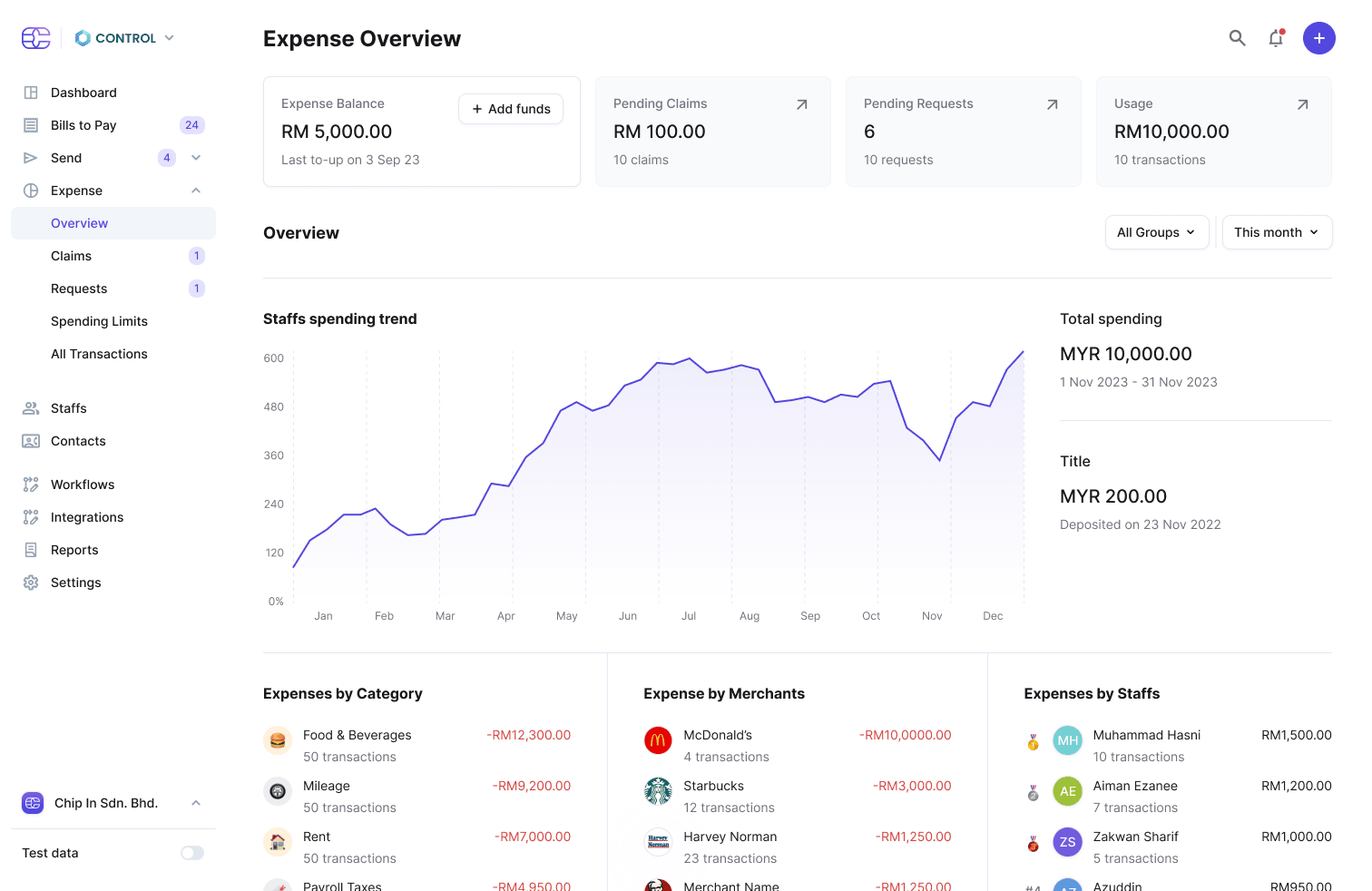

Streamline Your Team's Expense Management

CHIP Expense simplifies your expense management with automated tracking, insightful analytics, and seamless integrations.

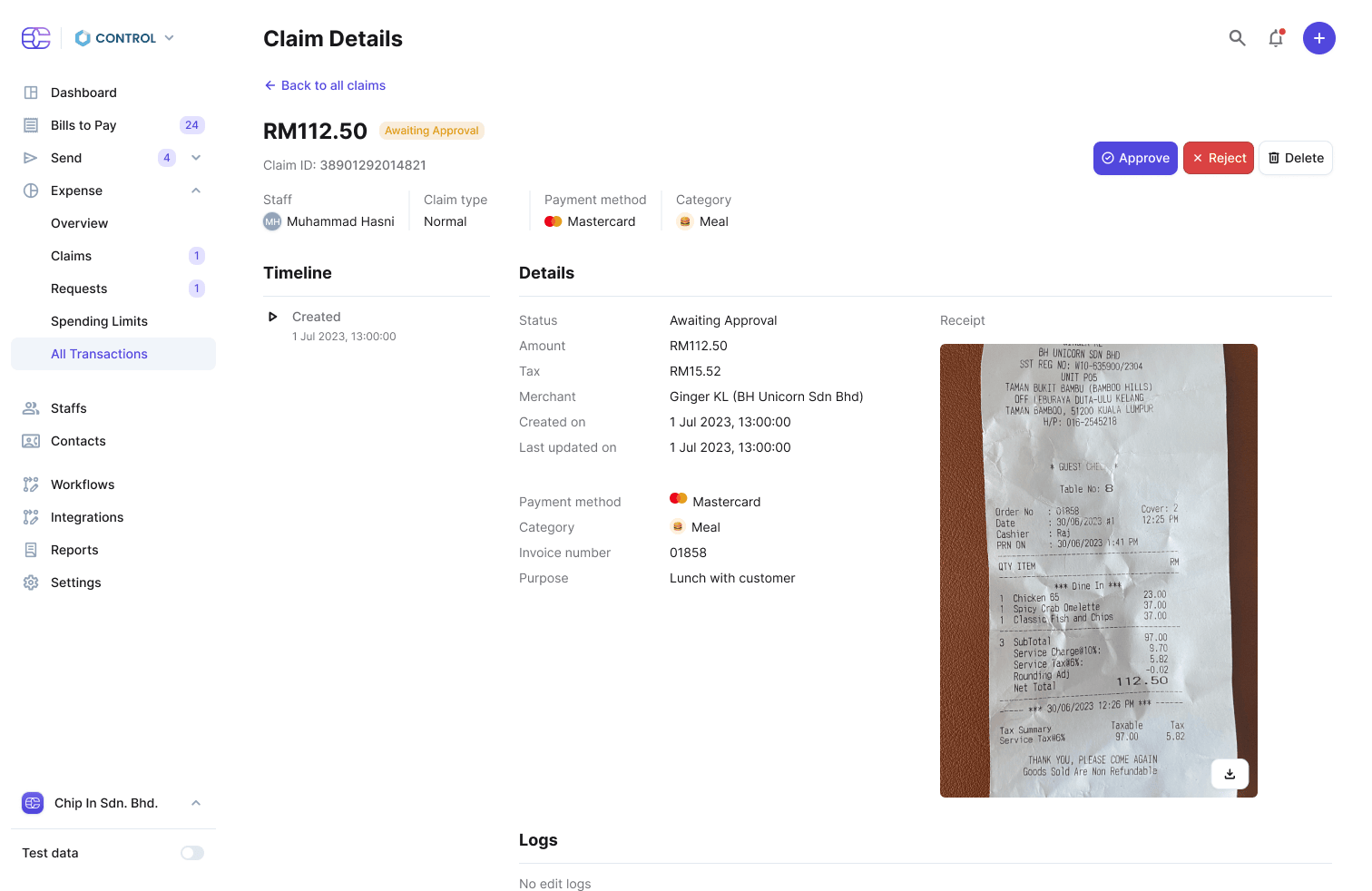

Expense Reporting Made Effortless

ULTIMATE EXPENSE CONTROL

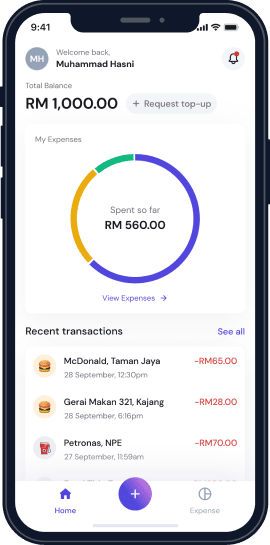

Keep Control Over Staff Spending

CHIP Expense ensures that staff spending stays within limits by enabling pre-defined budget allocations.

Freeze and allocate funds in real-time and safeguard your business with our comprehensive tools against fraud and overspending.

Smart Financial Management

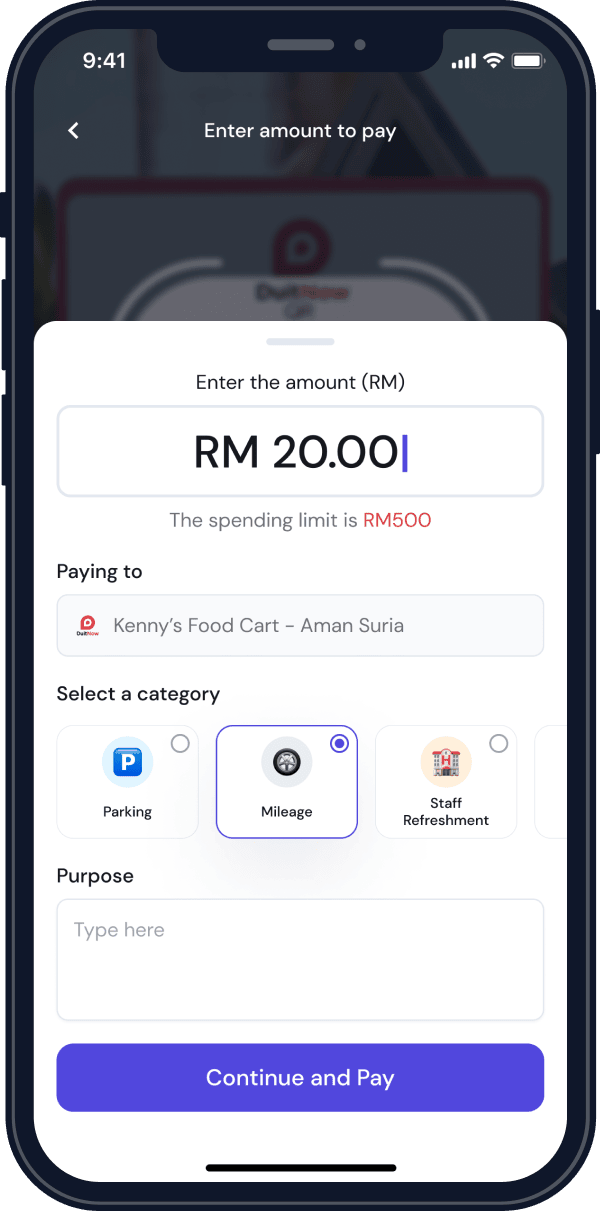

Enjoy Proactive Spending Limits

Setting up spending limits in CHIP Expense goes beyond mere budgeting. They act as a proactive financial control mechanism, empowering you to manage your team's spending effectively.

Assign specific spend limits and vendor constraints effortlessly—no more awkward conversations or micromanagement, just smart control.

Empower Your Finances with Streamlined Expense Management

CHIP's security

We understand that in order to serve our customers, we have to diligently protect your financial information with industry-leading standards, protocols, and technology.

Why use CHIP Expense?

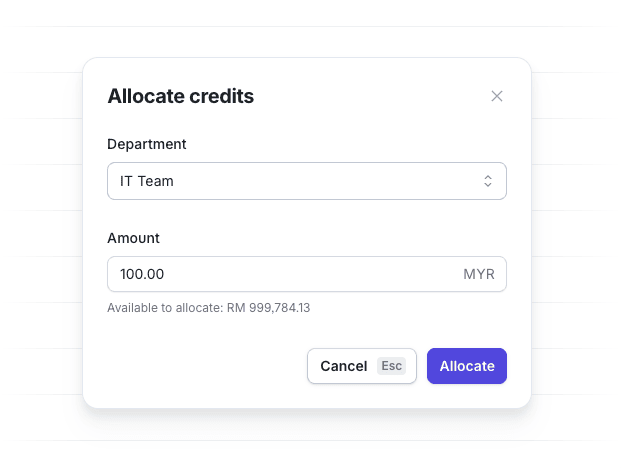

Customize Budgets to Your Business Needs

Maximize your resources by tailoring budgets to specific departments, teams, or projects. Add or remove personnel flexibly to align with your strategic objectives.

Fund Allocation Across Platforms

Whether you’re on the go or at your desk, managing budget approvals is just a notification away. Make informed decisions with ease from any device.

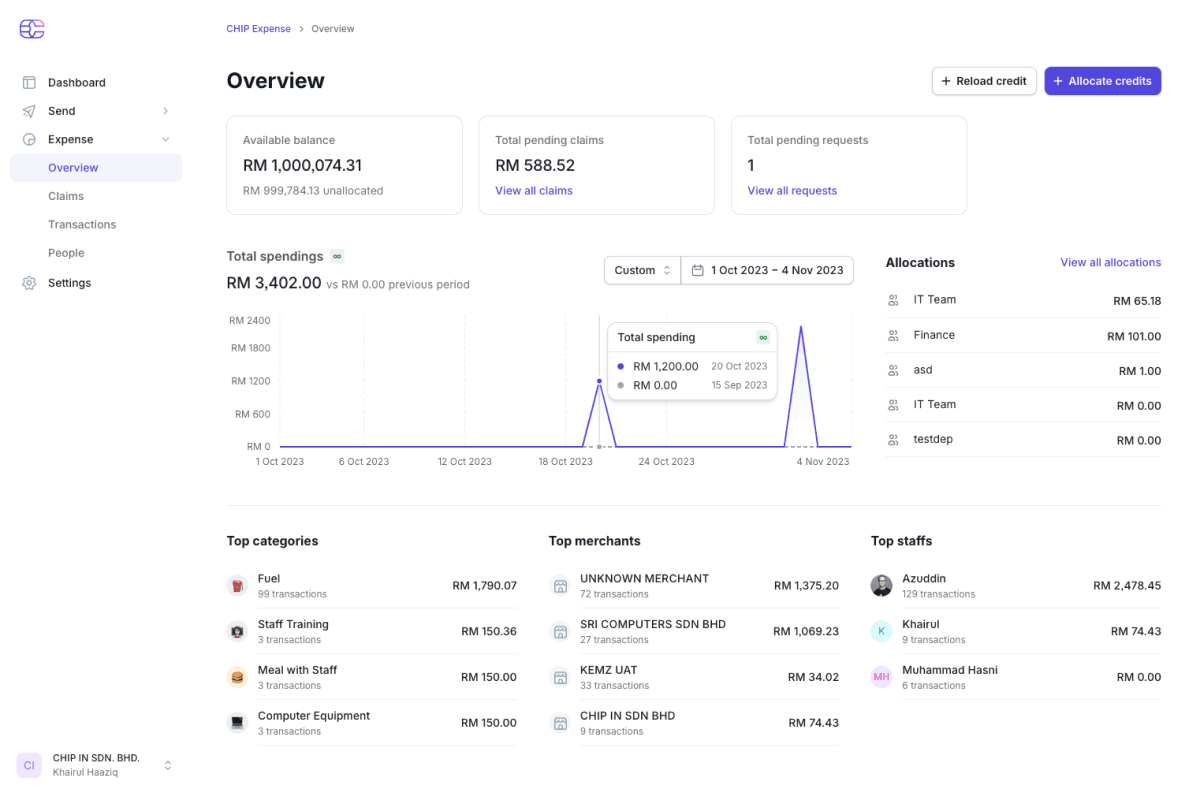

Real-Time Spending Insights

Keep your finger on the pulse of your finances. Our platform provides a live view of expenditures against budgets, ensuring you’re always informed about your financial position.

Detailed Expenditure Analysis

Gain valuable insights with detailed reports. Break down spending data by department, team, or individual to make data-driven decisions.

Project and Periodic Budget Reviews

Evaluate past expenditures and plan for the future with our budget review tools. Adjust financial forecasts to stay on track with your fiscal goals.

Team-Based Budget Management

Empower your team leads with the autonomy to manage their own budgets through customized access and control settings.

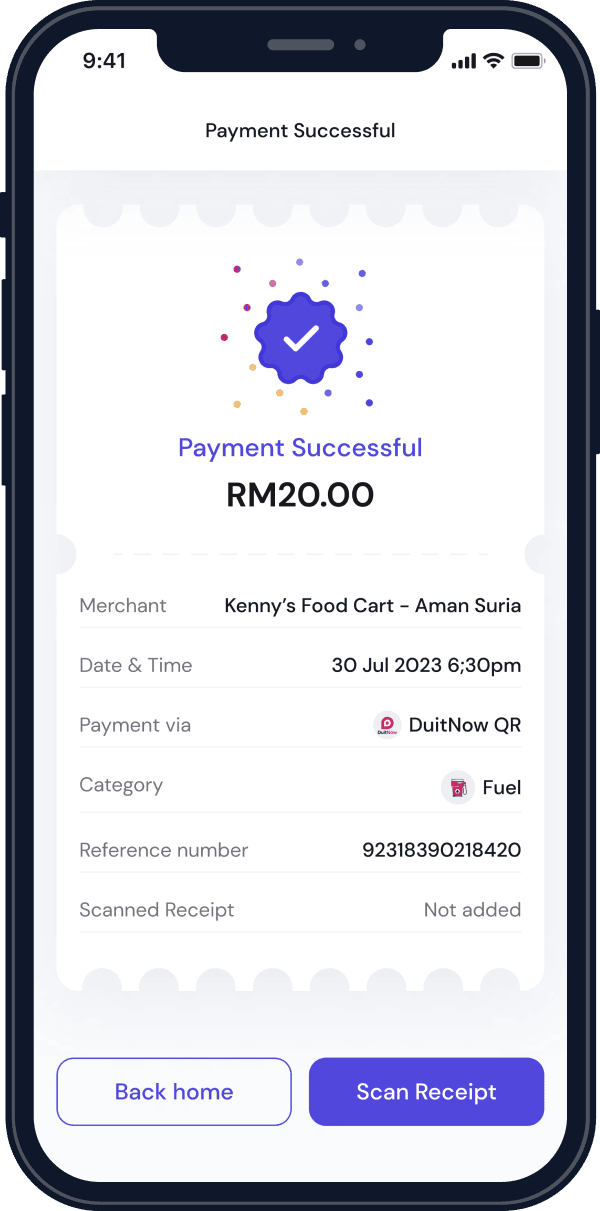

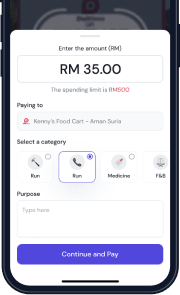

Instant Mobile Notifications

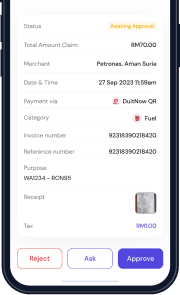

Enable your staff to request funds on demand. Approvals or rejections are just a tap away with instant notifications to your mobile device.

Proactive Expenditure Controls

Implement pre-approval for expenses to prevent budget overruns. Ensure every spend is justified and accounted for within your financial strategy.

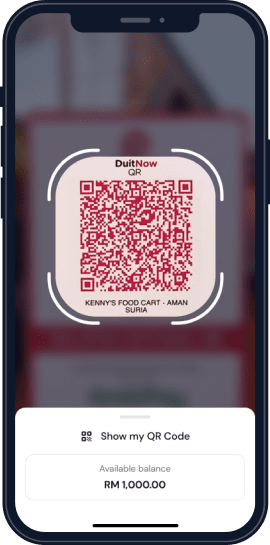

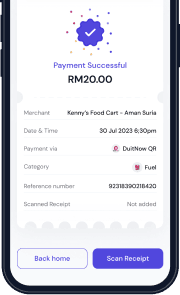

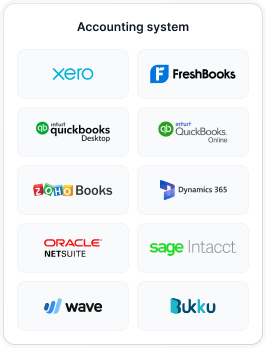

Accelerate Your Reconciliation Process

Bid farewell to the time-consuming task of reconciling credit card and petty cash statements every month.

With CHIP Expense, simply scan a QR code and your expenses are automatically categorized and queued for synchronization with your accounting system, ensuring the quickest path to month-end closure.

Commonly asked questions

Contact us

Drop any questions in the form below, and we will reach out to you soon!

Need a support? Email us at

support@chip-in.asia