Accept payment online or over-the-counter with CHIP Collect

Whether you run your business on a website, social media or from a physical store - we have solutions to fit your needs.

CHIP Collect super powers

We design our solutions to let you focus on running and growing your business.

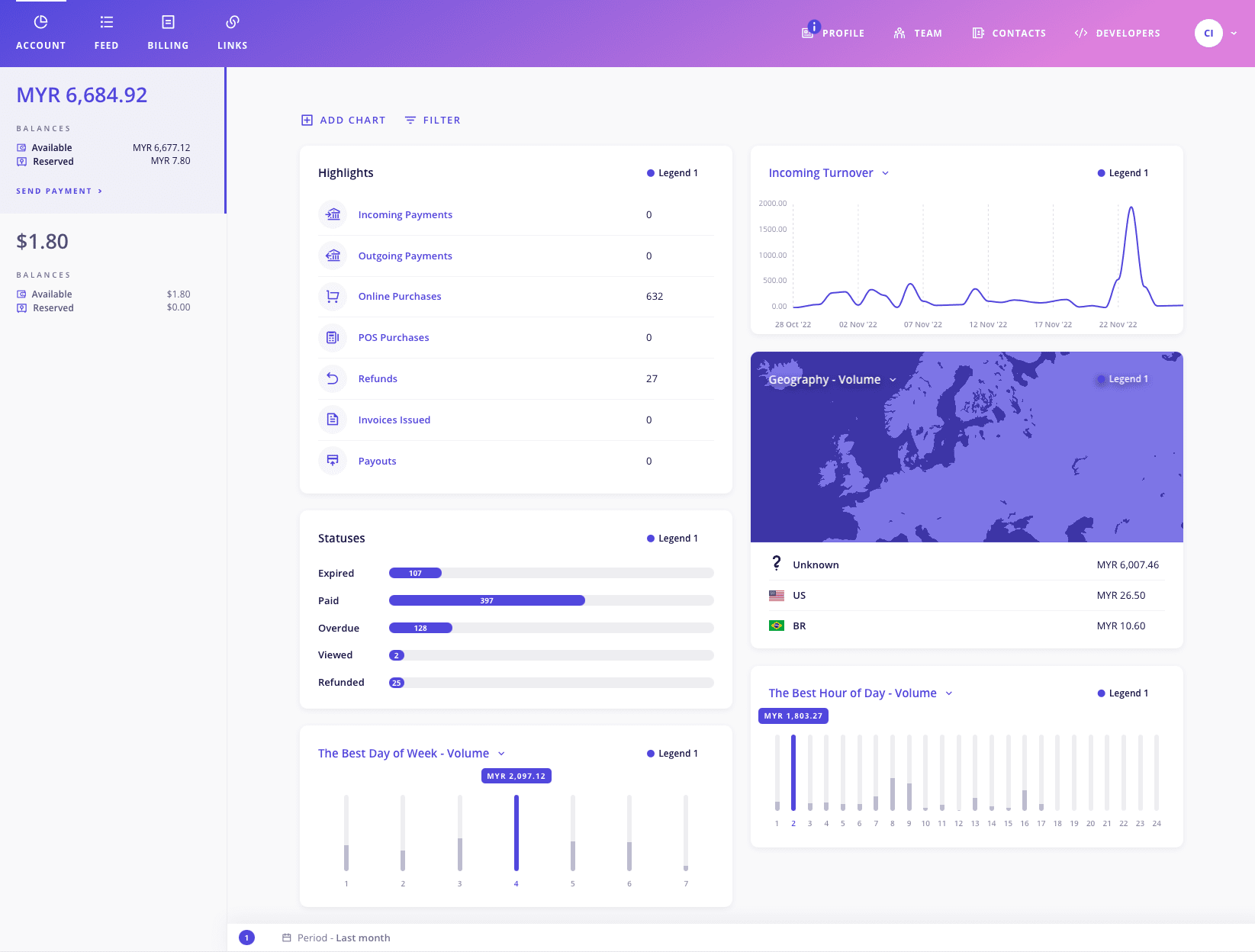

Powerful Dashboard & Analytics

Assign specific roles for team

Initiate refund easily

Toggle easily between staging & production environment

Fast approval

Easy-to-setup recurring payment

Accept cross-border payments

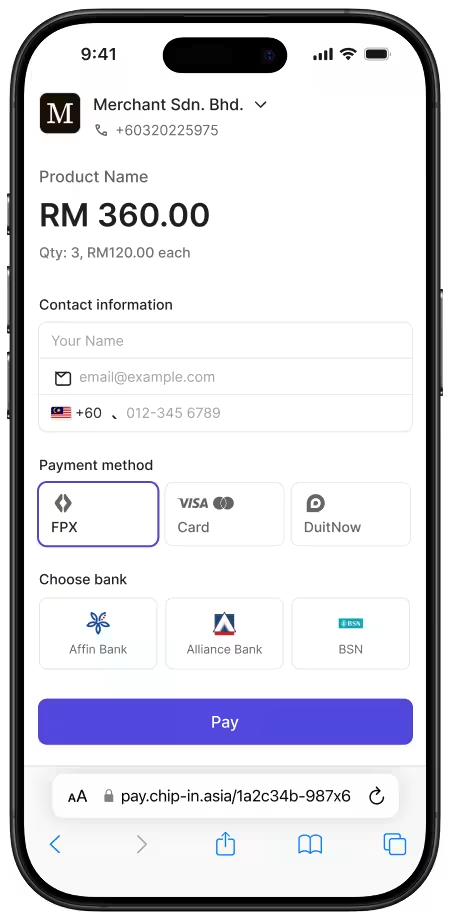

Customisable Secured Payment Page

Security and compliance

We put security and scalability above everything else. We bring together best practices and technologies to ensure a safe & reliable platform for our merchants.

Certified

Certified

Level 1 compliant

Our payment stacks

Maximise your collection and revenue with smarter tools.

Consolidate on-premise & online collection + cross-border payments (future)

Reconcile, analyze and project collection for every campaign

Collect via customizable invoices, links and terminals

Connect with accounting software and e-Commerce platforms

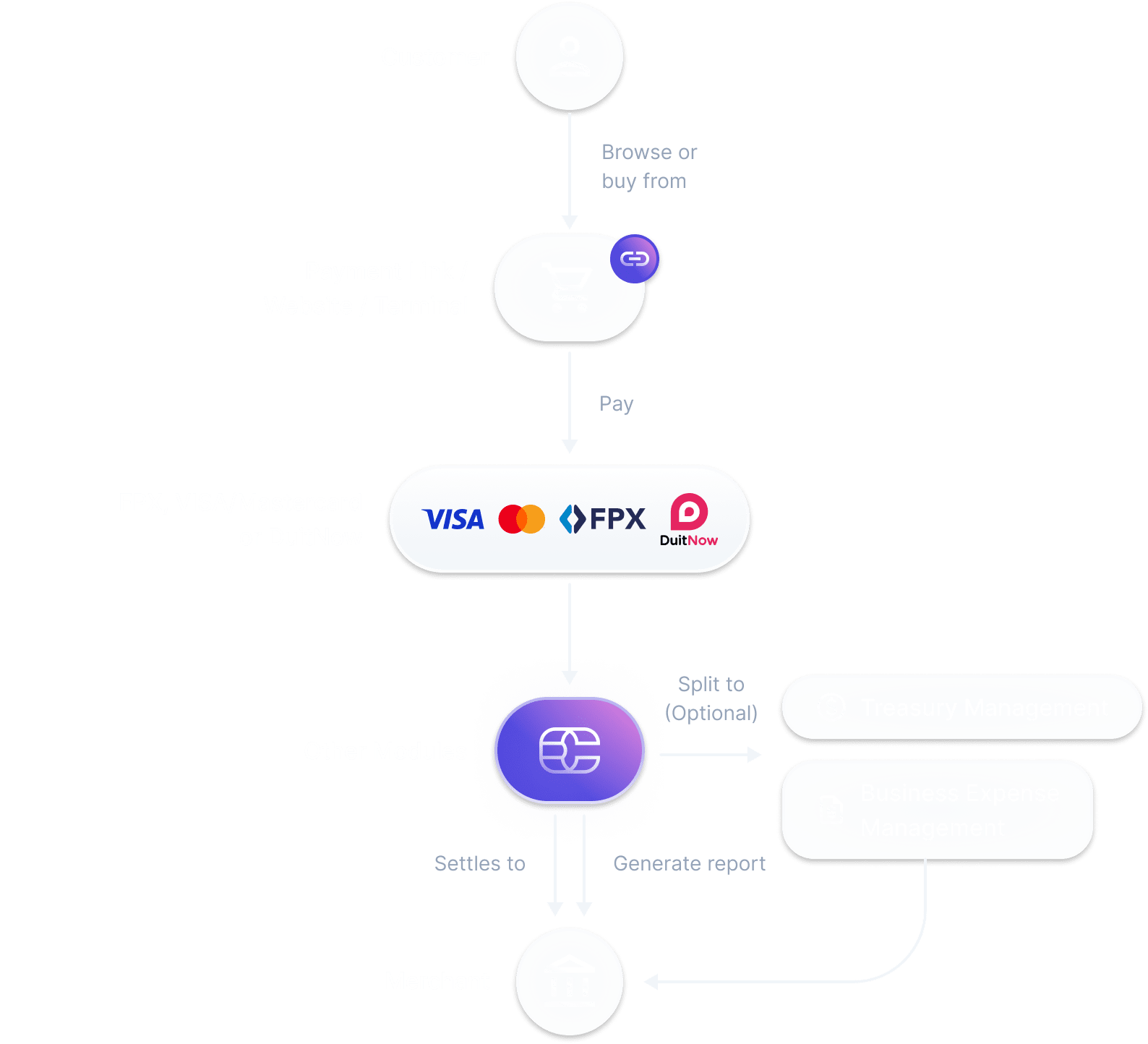

Split settlement to multiple bank accounts and/or other CHIP modules

Opt for customized settlement speed & transactional rates

Fee and Settlement

Our fee and settlement is tailored for businesses of every sizes.

FPX Online Banking

The most popular online payment methods in Malaysia. Collect payment from individual customers (FPX B2C) & corporate client (FPX B2B1).

Local credit and debit cards

Collect online payment from Malaysian customers who prefer to pay using credit, debit or prepaid cards.

On-Premise POS Terminal

Accept payments at your physical store using a point of sale terminal.

Foreign credit and debit cards

Collect card payment online from customers globally.

E-wallets

Collect online payment from customers who prefer to pay using e-wallets.

Buy Now, Pay Later

Allow customer to make purchases today and pay them at future dates.

DuitNow QR (Online)

Collect payment from customers who opt to scan digital QR codes – including support for cross-border QR payments, ideal for international customers from Indonesia, Thailand and Singapore. Learn more

DuitNow Online Banking & Auto-Debit

Collect online payment from individuals & corporate client.

Merchants’ use cases

CHIP Collect can be used by any business of any size to collect fast, secure payments.

With Website / App

- Easy-to-use API

- Multiple libraries

- Ready webhook

- iOS & Android SDKs

Without Website / App

- Customizable payment link

- Donation feature

- Social media enabled

- Quick invoicing

Online Sales Platform Partners:

With Physical Outlet

- Ready terminal to accept QR and card

- Consolidated reporting between outlet & online sales

Your favourite plugins 🤝 CHIP

Super charge your online store with CHIP-compatible plugins.

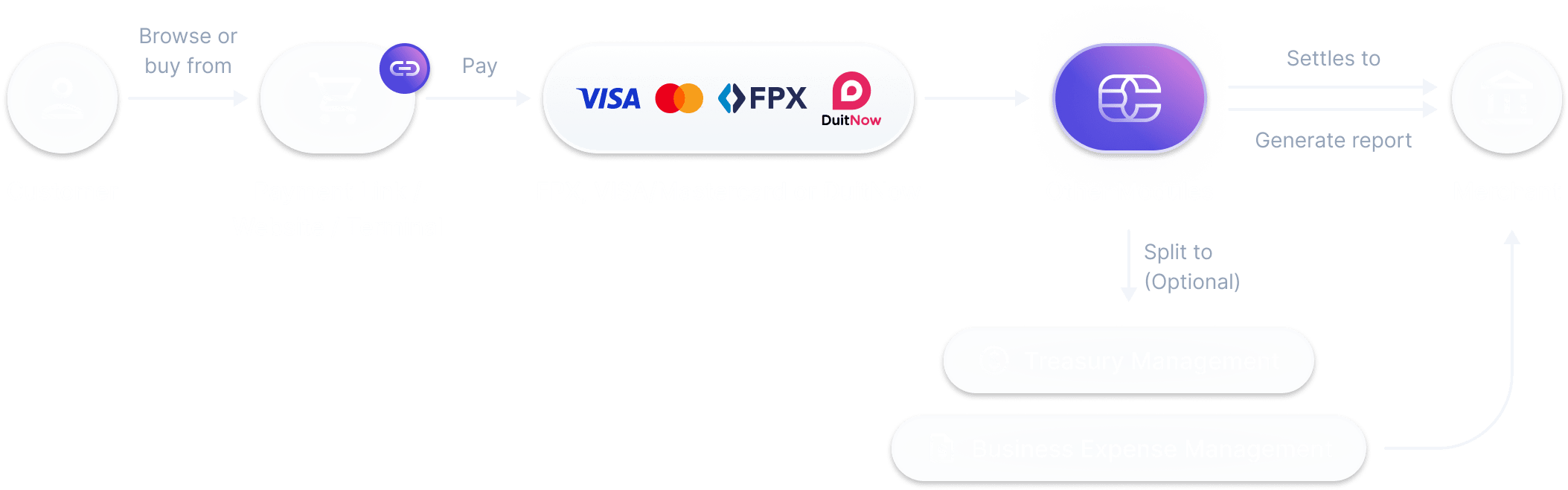

How it works?

We simplify the complex processes in every payment flow.

Need an access to a test account?

Register for free now and toggle between testing and actual portals easily!

Contact us

Drop any questions in the form below, and we will reach out to you soon!

Need a support? Email us at

support@chip-in.asia